Houses of worship go solar

Faith leaders and solar installers discuss how and why houses of worship are going solar and how the clean energy tax credits in the Inflation Reduction Act can help.

Houses of worship across America are going solar — putting their values into action, helping protect God’s creation, and saving money on their electric bills at the same time.

On May 18, 2023, Environment America Research & Policy Center and the Texas Solar Energy Society hosted a panel discussion featuring Reverend Richard Neusch, the Senior Leader of the Pastoral Staff at True Life Fellowship in Round Rock, Texas; Louis Petrik, the CEO of Longhorn Solar; and Dub Taylor, the Chief Operating Officer of the Texas PACE Authority. The panelists discussed why houses of worship are going solar, how they are going about it, and how to tap clean energy tax credits available to faith-based nonprofits for the first time this year. The panel was moderated by Johanna Neumann, Senior Director of the Campaign for 100% Renewable Energy at Environment America Research & Policy Center.

Watch the webinar recording below, and continue reading for key takeaways from the event.

Recording of Solar on houses of worship webinar

Rooftop solar is the perfect technology for the moment we’re in

In opening comments, Neumann referenced the abundance of America’s renewable energy sources, in particular the rays of the sun that shine down on us every day. “America has solar energy potential in spades,” said Neumann.

She went on to say that rooftop solar warrants a special place in our energy future because it is efficient, reduces the need for costly and destructive transmission lines, and can help communities become more resilient. Neumann added that houses of worship are perfect places for solar panels because during the week, when the building isn’t used as much, their clean energy can be used by households and businesses in their community, but on Sundays or holy days, they can tap the solar to power their own building with clean renewable energy.

Now is a perfect time for houses of worship to go solar.Johanna Neumann

Senior Director, Campaign for 100% Renewable Energy, Environment America Research & Policy Center

“Looking to the heavens for their power”

In the panel discussion, Reverend Richard Neusch shared his experience installing solar at True Life Fellowship in Round Rock, Texas. Prior to installing solar panels, Neusch, the senior leader of the pastoral team at the church, had done extensive research and considered the long-term benefits of the investment. He said solar saves his congregation money and sends a message that they care about the environment. He explained that after True Life Fellowship became the first church in Round Rock to go solar, the local newspaper ran a story with the headline” “True Life is looking to the heavens for their power”. Neusch explained that he felt that headline was perfect on so many levels.

Louis Petrik, the CEO of Longhorn Solar, who also happens to be a member of True Life Fellowship explained that his company, one of the “old dog” solar companies in Texas, installed the solar panels on True Life. He said True Life’s building was perfect for solar because its broad southern and western facing rooftops would help the church maximize its solar investment.

We like doing houses of worship because… it increases curiosity and makes people want to know more about [solar].Louis Petrik

CEO, Longhorn Solar

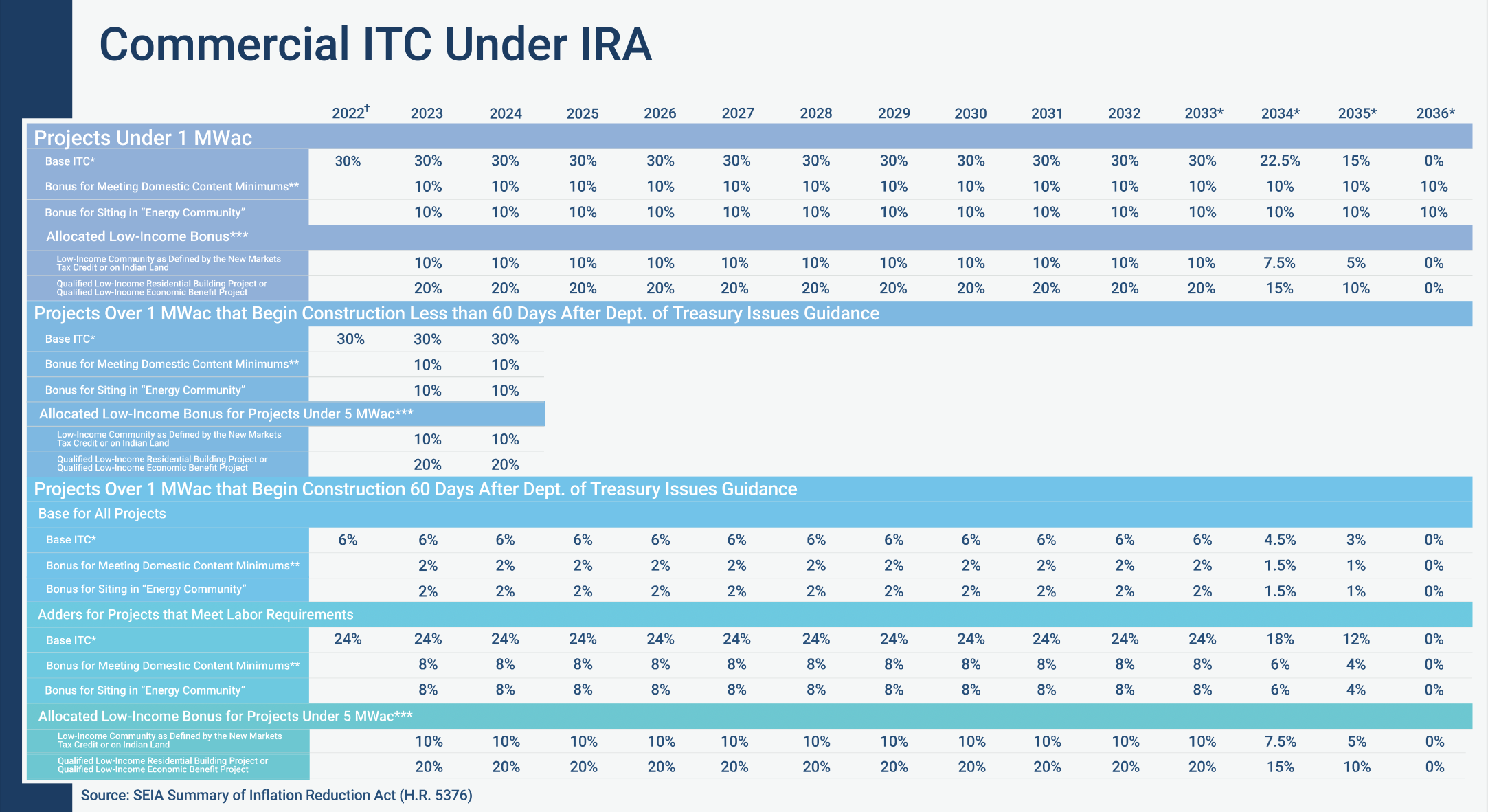

Petrik went on to explain the clean energy tax credits in the Inflation Reduction Act. The Inflation Reduction Act was passed by Congress and signed into law by President Biden in the summer of 2022 and makes the largest investment in clean energy in America to date.

Petrik said that under the law, non-profit houses of worship are eligible for a refundable tax credit for 30% of the cost of the solar system and installation. He explained that there are also additional credits that can be applied, including an additional 10% if the system meets certain domestic content requirements and another 10% if the project is in an “energy community”. “Energy communities” are communities that have historically been associated with fossil fuel extraction and production as detailed in this Department of Energy map. Petrik explained that if a solar project was eligible for all the adders, they could see a 50% refund. The Department of Energy’s website on the Investment Tax Credit as it applies to faith-based nonprofits offers more details.

Petrik explained that the more visible a solar array is, the more it becomes accepted. He said when people see solar on their church it increases their curiosity. He said he likes doing houses of worship because it gets the community interested in clean energy.

God taught us to take care of the planet. That's one of the things that's throughout the Bible. It just makes sense for houses of worship to actually explore this and be leading the flock.Louis Petrik

CEO, Longhorn Solar

The final panelist was Dub Taylor, the Chief Operating Officer of the Texas PACE Authority. Taylor explained that PACE stands for Property Assessed Clean Energy, and it’s a way to finance energy projects that might have a high up-front cost but offer long-term savings. PACE financing, which is available in 30 states, including Texas, uses local government assessment mechanisms to provide security for funding private distributed energy projects. Taylor explained that a church in Fort Worth used PACE to finance a solar array on a newish building and an older church in Houston that had an aging underperforming HVAC system with ventilation and moisture issues, addressed their facility needs and added solar through PACE. The Texas PACE project website offers descriptions of these projects and more.

Taylor added that until recently, power in Texas was cheap so there was less incentive to be efficient or go solar. But now, especially in the wake of Winter Storm Uri, electricity is more expensive and a lot of fixed costs of maintaining the grid over coming decades will be spread to all consumers, which is true in Texas and across the nation. Taylor explained that controlling your own power makes more sense going forward.

The design of the program is for it to to be cash-flow positive for the owner day one, and throughout the life of the projectDub Taylor

COO, Texas PACE Authority

Following the panelists remarks, members of the audience posed a broad range of questions including what are the best steps are to going solar (get an energy audit first, get a number of quotes), whether solar panels can be installed on slate church roofs (not very well), whether there are limits on federal tax credits (no), whether solar on parking lots should be considered (yes), whether it makes sense to add battery storage, and more.

Our environment is in crisis, and we have the solutions. For the reasons we discussed today, houses of worship are perfect places for this energy transition to happen.Johanna Neumann

Senior Director, Campaign for 100% Renewable Energy, Environment America Research & Policy Center

Going solar and adding storage: how federal tax credits can help

Topics

Authors

Johanna Neumann

Senior Director, Campaign for 100% Renewable Energy, Environment America Research & Policy Center

Johanna directs strategy and staff for Environment America's energy campaigns at the local, state and national level. In her prior positions, she led the campaign to ban smoking in all Maryland workplaces, helped stop the construction of a new nuclear reactor on the shores of the Chesapeake Bay and helped build the support necessary to pass the EmPOWER Maryland Act, which set a goal of reducing the state’s per capita electricity use by 15 percent. She also currently serves on the board of Community Action Works. Johanna lives in Amherst, Massachusetts, with her family, where she enjoys growing dahlias, biking and the occasional game of goaltimate.

Find Out More

Which 10 American retailers can lead the way on rooftop solar?

More rooftop solar, less red tape

Unlocking America’s rooftop solar potential