Funding the Future of Superfund

Addressing decades of slowing toxic waste cleanup

The Superfund toxic waste cleanup program is in charge of cleaning up America's most dangerous toxic waste sites. But for years, it's been underfunded, which has slowed down cleanup and put more people at risk of exposure to hazardous waste. The Funding the Future of Superfund: Addressing decades of slowing toxic waste cleanup report addresses the progress of the Superfund program in 2021 and what new funding from the reinstated "polluter pays" tax will mean for the future of Superfund toxic waste cleanup.

Downloads

Environment Maryland Research & Policy Center

EXECUTIVE SUMMARY

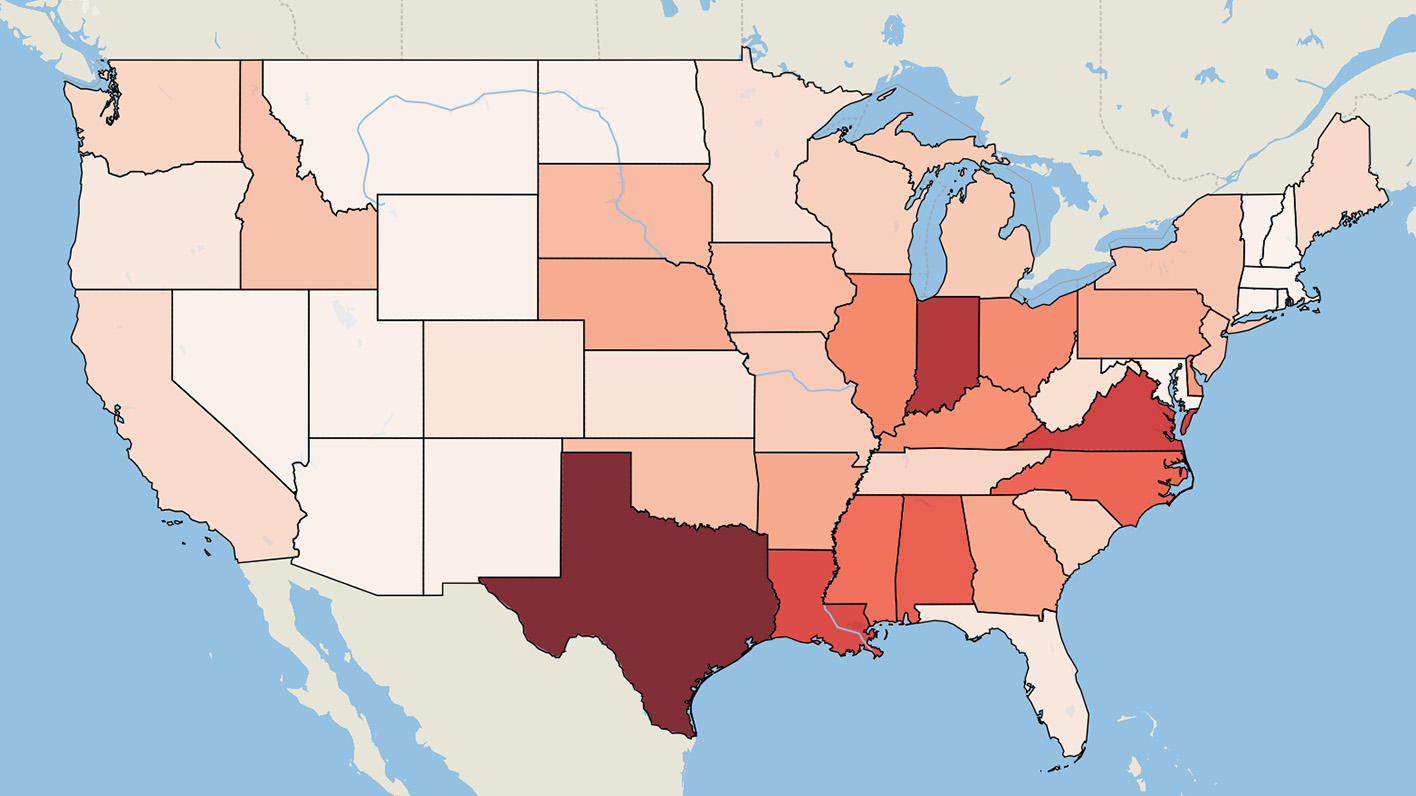

One in six Americans live within three miles of a toxic waste site that is so dangerous it has been proposed or approved for cleanup under the U.S. Environmental Protection Agency’s (EPA) Superfund program. Less than a quarter of the more than 1,700 sites that have been added to the Superfund program’s National Priorities List since it was created in 1980 have been deleted, which is the final step in confirming all cleanup goals have been achieved at the site.

Contaminants of concern at toxic waste sites on the National Priorities List include arsenic, lead, mercury, benzene, dioxin, and other hazardous chemicals that may increase the risk of cancer, reproductive problems, birth defects, and other serious illnesses.

None of those chemicals should be at these sites in the first place. Superfund sites are above all the result of mismanaged waste. For decades, industrial activity has ignored the accruing human health, environmental, and financial cost of using toxic chemicals. It is long past time to put “safety first” into practice.

For the past 26 years, federal policy has helped entire industries to ignore that growing cost by shifting the financial burden for cleaning up Superfund sites from industry and onto individual, American taxpayers. The program was originally funded by a set of “polluter pays” taxes on the chemical and petroleum industries. Funds from these taxes went into a Trust Fund designated to fund the Superfund program. Since Congress let those taxes expire in 1995, the EPA has increasingly relied on money from general taxpayer revenue to make up the shortfall, but it hasn’t been enough. Past revenue from the polluter pays taxes kept the Trust Fund’s unobligated balance above zero until 2003, but shortly after the policy expired, cleanup progress at Superfund sites dropped.

As funding to the Superfund program decreased, cleanup slowed, putting more people at risk for longer from hazardous contamination.

- Shortly after the polluter pays taxes expired, the Superfund Trust reached its peak balance of $4.7 billion at the start of FY 1997 and then began declining in FY 1998. At the start of FY 2022, the Trust had a balance of $67 million.

- Annual appropriations decreased by more than a billion dollars from just under $2.5 billion in 1999 to $1.2 billion in 2021, in constant 2021 dollars. At the same time, the number of remedial cleanup actions that began each year fell from 91 in 1999 to 14 in 2021.

- Cleanup actions include construction projects, which is the physical work needed to clean up a site. 37 construction projects did not begin in FY 2021 because of a lack of funding.

Today, the Superfund program pays for all or part of cleanup at 45% of all National Priorities List sites.

- The EPA attempts to get the company and/or individuals responsible for polluting a site, referred to as Potentially Responsible Parties (PRPs), to pay for the site’s cleanup. However, when PRPs can’t be identified or can’t afford the cleanup, the EPA pays for and conducts cleanup. At some Superfund toxic waste sites, the PRPs and the EPA share the cost. At 45% of all National Priorities List sites, the EPA is either paying for the entire cleanup or sharing the cost with PRPs.

- At 30% of all Superfund National Priorities List sites, there is no PRP to pay for or conduct cleanup, and the Superfund program pays for and conducts the cleanup

- The increased funding opportunity from the polluter pays tax will benefit cleanup efforts at sites across the country, but may have the greatest impact at so-called “orphan sites” where the EPA is footing the entire bill.

Following the trend from the last 26 years, the EPA conducted far fewer cleanup actions in FY 2021 compared to the history of the Superfund program, since the first site was put on the National Priorities List in 1983.

- Cleanup actions at Superfund sites include long-term remedial actions, short-term removals, investigative studies, and physical construction work, among others. These cleanup actions indicate milestones a Superfund site reaches as it moves toward reaching all cleanup goals and being deleted from the National Priorities List. The number of Construction Completions at National Priorities List sites in FY 2021 dropped more than two-thirds below the yearly averages since the first National Priorities List.

- Between 1983 and 2020, there was an average of 57 Superfund toxic waste site Remedies and Final Remedies Selected each fiscal year. In FY 2021, there were 19.

In a victory for human health and the environment, Congress passed, and President Biden signed, the bipartisan infrastructure bill reinstating the polluter pays tax on hazardous chemical production to fund the Superfund program in November 2021. After 26 years, this renewed source of funding will give the program an opportunity to reverse the decades-long trend of slowing progress.

- From 1991 to 2000, when the Superfund Trust was at its highest balance, each year saw an average of 71 Construction Completions. As the balance of the Trust Fund continued to decline from 2001 to 2010, that number fell to an average of 34 construction completions each year. From 2011 – 2020, that number fell to an average of 12 construction completions each year. In FY 2021, construction was completed at only eight sites.

- The polluter pays tax is projected to bring the Superfund Trust Fund to a $1.8 billion balance by the end of the Fiscal Year, up from $67 million at the start of FY 2022.

- The reinstated polluter pays tax on chemical production is expected to raise approximately $14.45 billion over the next decade to bolster cleanup efforts at Superfund sites across the country.

To ensure this new funding translates to results in the form of cleanups, the EPA should create and make publicly available its goals for the Superfund program to inform Congress about the funding necessary to reach those goals.

- In order to identify and address any ongoing funding shortfalls that prevent the EPA cleaning up Superfund sites as quickly as possible, the EPA should collect, analyze, and release data regarding cost and time expected to reach cleanup milestones at sites currently on the National Priorities List.

- The type of sites added to the National Priorities List has changed over the decades, and the EPA should conduct estimates of the type of toxic waste sites expected to be addressed by the Superfund program in the future in order to accurately request and distribute funding, which may necessitate increasing polluter pays fees.

To ensure future environmental disasters do not threaten to undo cleanup work, Superfund site cleanup plans should take into account the risk of worsening natural disasters.

- At least 800 Superfund sites are at risk of flooding in the next 18 years due to sea-level rise, even in the most conservative scenarios. Adverse weather events such as flooding threaten to sweep away contamination and spread it to nearby communities, making cleanup more difficult and expensive.

- Climate change is increasing the frequency of severe hurricanes and wildfires. In order to reduce the risk of flooding, hurricanes, or wildfires damaging Superfund toxic waste sites and spreading contamination into nearby communities, cleanup plans should be designed and implemented to endure severe weather risks.

Topics

Find Out More

The Threat of “Forever Chemicals”

Who are the top toxic water polluters in your state?