Alaska Winter Weatherization and Efficiency

Make your home cozy, lower your utility bills, and help protect the environment

A guide on improving the efficiency of your home using rebates tax credits, and DIY.

What is weatherization and efficiency, and why do they matter?

The cleanest and cheapest energy is the energy we never produce or use. There are two key ways to reduce energy use: energy conservation refers to changing behaviors to reduce energy use and energy efficiency measures refer to technological upgrades that reduce energy use.

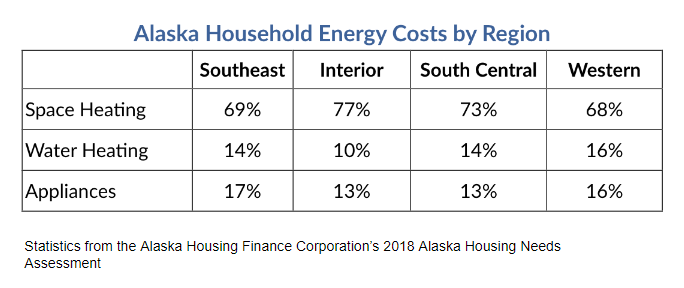

It won’t surprise anyone that heat is the largest energy expenditure in almost every Alaska home.

Photo by Alaska Housing Finance Corporation | Used by permission

Weatherization refers to conservation and efficiency measures specifically aimed at keeping homes dry and at a comfortable temperature with less energy.

How do I begin?

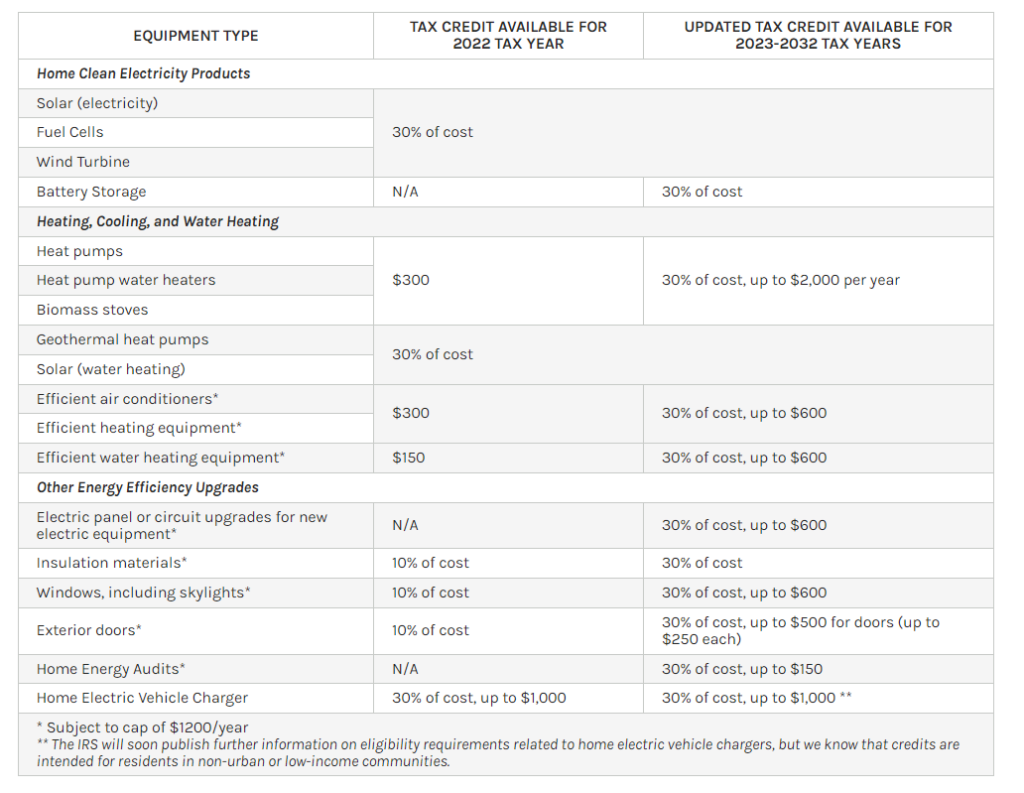

Improving the efficiency of your home could include larger projects that you’ll need a contractor or specialized skills to accomplish, new equipment like a heat pump, and smaller projects you can take on yourself. You can get a basic idea of what projects your home might need using this checklist from Alaska Energy Smart. There are currently active tax credits and an upcoming income dependent rebate program that can help with purchasing new appliances, adding insulation to attics and basements, and taking on other larger projects. Details on the rebates, tax credits, and DIY are below.

Weatherization and Efficiency Webinar

Colleen Fisk from REAP and Ethan Stoops from the Alaska Housing Finance Corporation discuss energy efficiency, weatherization, upcoming rebates, and DIY projects.

Rebates

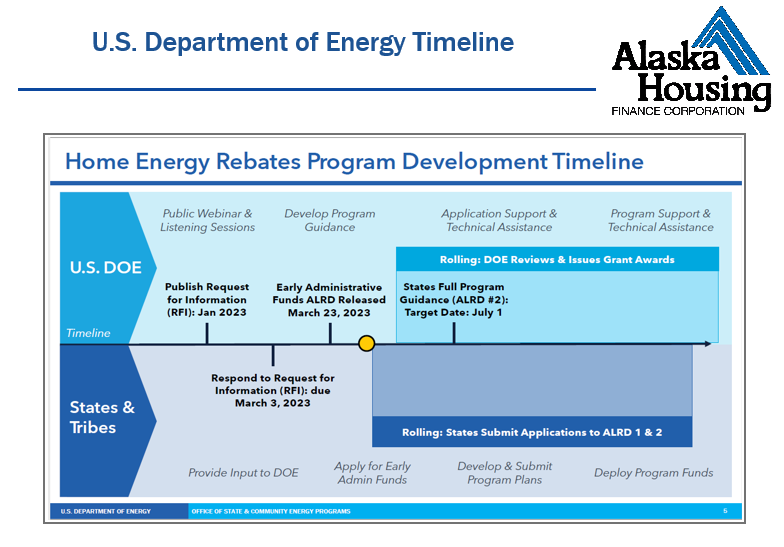

The Inflation Reduction Act allocated significant funds to help folks weatherize and electrify their homes. The Alaska Housing Finance Corporation will administer the program in Alaska.

The DOE has released a framework for the funding and now they are working on the tools and support systems. After those come out, states will need to develop their programs, submit to DOE for review, after approval, funding will be released.Photo by Alaska Housing Finance Corporation | Used by permission

The timeline is not set in stone, but ideally funding will become available in the late spring or early summer of 2024.

The rebates will only be available to folks who fall below a certain household income. The largest rebates will be available to households that make less than 80% of the area median income. Smaller rebates will be available to households that make between 80% and 150% of the area median income. You can check the area median income for your borough here.

Frequently asked questions about the rebate programs

What point of sale rebates will be available?

- Households at 80% or less of area median income are eligible for either the full cost of the appliance or 100% of the rebate listed below, whichever is less.

- Households at 80-150% of area median income are eligible for up to 50% of the cost of the appliance or the rebate listed below, whichever is less.

- Households above 150% of the median income won’t be eligible for rebates, but will be eligible for tax credits, see above.

- Home electrification and appliance rebates are capped at $14,000 per household.

- Heat Pump Heating/Cooling $8000

- Heat Pump Water Heaters $1750

- Heat Pump Clothes Dryers $840

- Electric Load Service Center upgrades/Breaker box (this needs to be updated in some homes when more appliances are electric) $4000

- Electric Wiring (this also sometimes needs an update for compatibility with new electric appliances) $2500

- Weatherization: Insulation, Air Sealing, Ventilation (makes your heat pump far more efficient and more viable) $1600

- Electric Stove, Cooktop, Range, and or oven (nothing to do with your heat pump, but goes into your rebate cap) $840

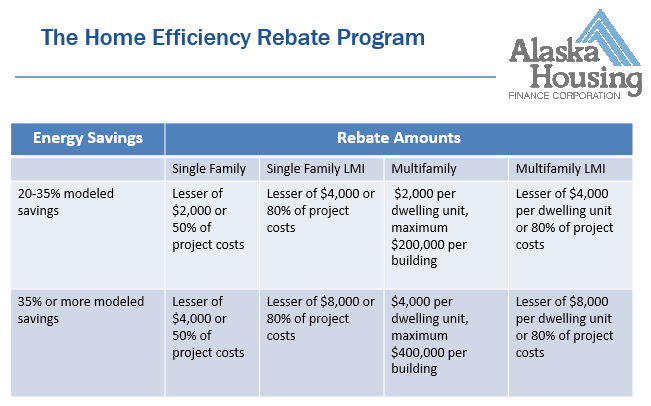

What about the Home Efficiency Rebate Program?

Folks will also be able to receive rebates for improving the overall efficiency of their home.

The largest rebates go to those who’s retrofits lead to energy savings of more than 35%. Low Median Income (LMI) households can get either 80% of their projects covered or a max of $8000. Other households can get 50% covered or a max of $4000.

Rebates are also available to folks whose projects save between 20% and 35%. LMI households can get 80% of costs covered or $4000 and other households can get 50% covered or $2000 max.

Photo by Alaska Housing Finance Corporation | Used by permission

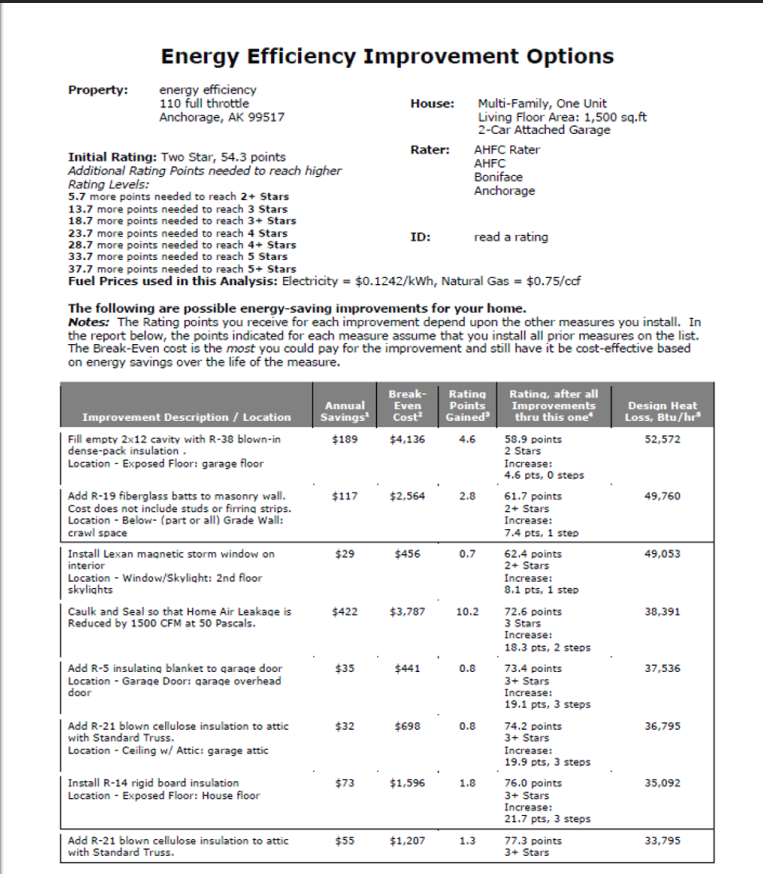

These start with an auditor coming to your home to determine which projects will improve your efficiency. Energy raters will be approved by the Alaska Housing Finance Corporation to use the AKWarm Energy Modeling Software, and after completing a review of your home, will give you a list of your options.

There is no income cap on this program. However, if you get a point of sale rebate for an appliance, it can’t go into your efficiency improvements under this program- no double dipping. These are not point of sale– rebates will be given during the following tax cycle.

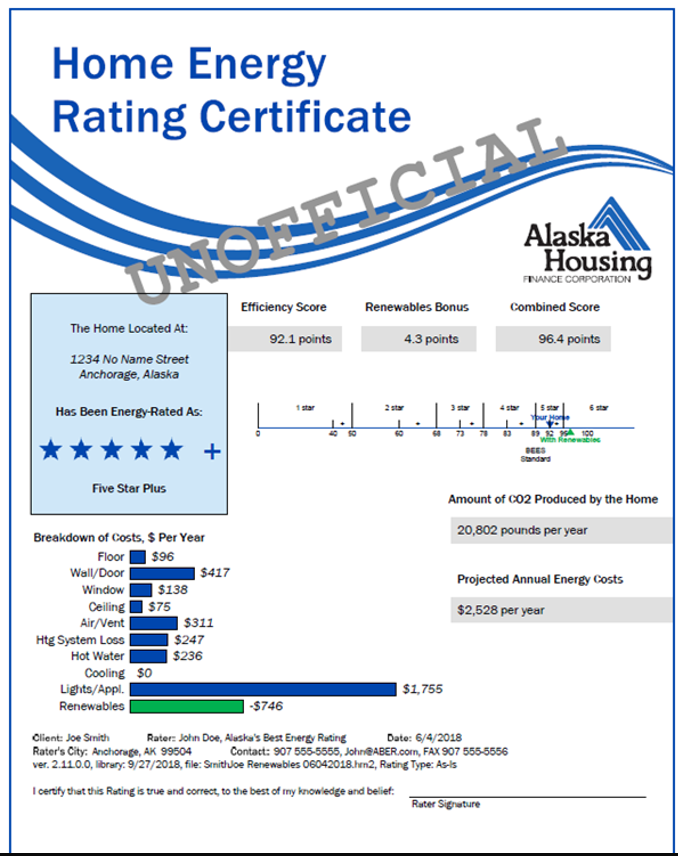

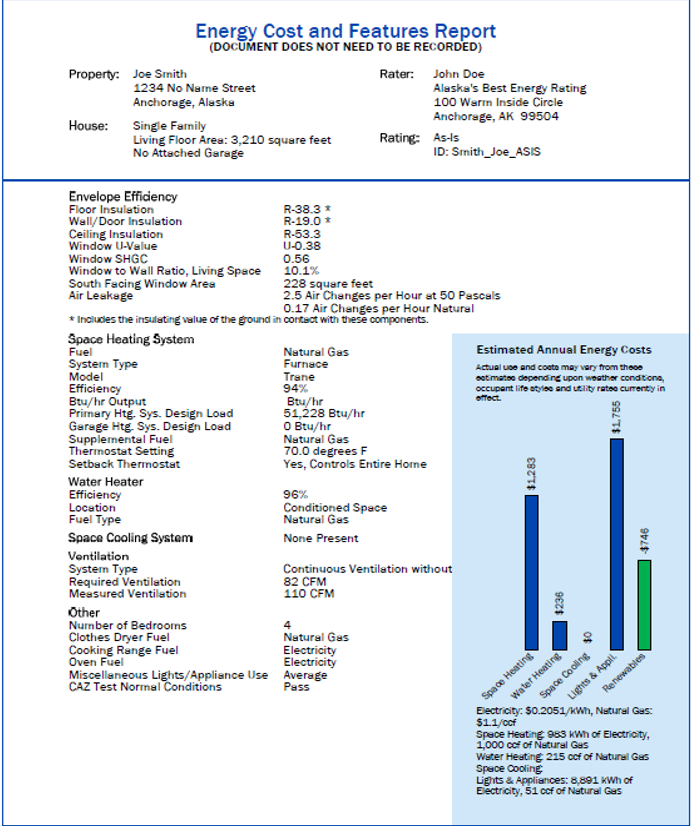

What information will my home energy rater give me?

Here is a sample of a Home Energy Rating Certificate. The certificate covers a broad summary, specific features, and which projects will have the biggest impact on your energy use.

Photo by Alaska Housing Finance Corporation | Used by permission

Photo by Alaska Housing Finance Corporation | Used by permission

Are apartment buildings or duplexes eligible?

Multifamily homes are also eligible for the home efficiency rebates, and the rebates are the same, but multiplied by the number of dwellings.