Navigating Inflation Reduction Act Benefits as a Non-Profit

President Biden’s clean energy plan, known as the IRA, has for the first time allowed tax-exempt entities to benefit from tax credits and rebates for clean energy investments

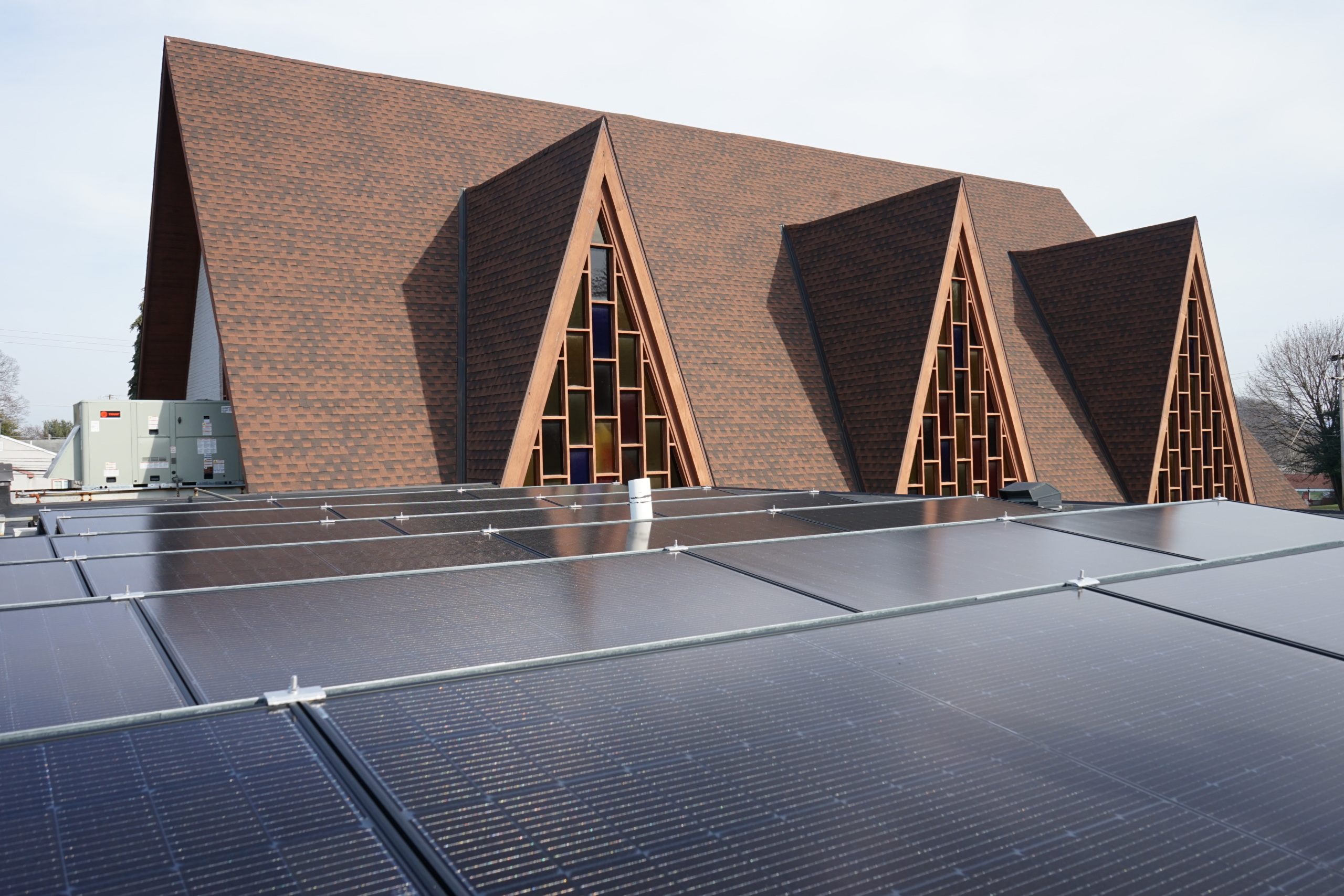

The Inflation Reduction Act, or IRA, is the largest investment in clean energy in US history, and much of that investment is delivered through tax credits and incentives. For the first time, non-profits, governments, schools, houses of worship, and other tax-exempt entities can benefit from these incentives through a process called Elective Pay (also known as Direct Pay).

With Elective Pay, these organizations are able to receive a payment for building or investing in qualifying clean energy projects. There are 12 clean energy tax credits that are available to nonprofits, including for the production of electricity from renewable sources like putting solar on their roofs and for purchasing commercial clean vehicles.

There are a couple steps to follow in the process of receiving these direct payments:

- Design and implement your qualifying clean energy project. You will need to know what credit you are applying for.

- Determine your tax year, if you don’t already know, either based upon a calendar or fiscal year.

- Complete pre-filing registration with the IRS:

- Create a Clean Energy Business Account for your organization at www.irs.gov/eptregister. This website also includes a comprehensive user guide and video tutorial.

- Select your Registrant Type (i.e., non-profit organization or local government). This is where you will provide information about your organization.

- Select the credits your organization intends to claim. You will provide supporting documentation for the projects or investments.

- Review and submit your requests for registration numbers. Don’t worry you can save your work in progress!

- After you submit your registration, you can monitor its status online. If everything checks out, you will receive a registration number.

- File your tax return and pick the corresponding direct pay election. This is when you will provide your registration number.

- Receive your direct payment after the tax return is processed!

The IRS has a comprehensive Direct Pay Guide, web resource, and FAQ resource. The White House additionally has a helpful guide, as well as the Treasury Department. Making the most of the benefits from the IRA is one of the best ways that we can jumpstart clean energy here and work to fight the climate crisis.

Additionally, check out our visualization of some of the benefits that non-profits can tap into.

Also, check out our Clean Energy Home Toolkit below to learn how you can make the most of these incentives, tax credits, and rebates as an individual and homeowner as well!

Clean Energy Home Toolkit

Topics

Authors

Ellie Kerns

Climate Field Organizer, PennEnvironment Research & Policy Center

Ellie works on PennEnvironment's climate change campaign and helps move forward climate initiatives. She lives in Philadelphia, where she enjoys photography and gardening.

Flora Cardoni

Field Director, PennEnvironment Research & Policy Center

Flora leads PennEnvironment's grassroots and field operations, working to mobilize activists and volunteers across the state to take action on all of our priority campaigns. Flora lives in Philadelphia, where she enjoys long walks around the city and taking in all of the art, culture and food it has to offer.

Find Out More

Key takeaways from Renewables on the Rise: Success Stories

Unlocking America’s rooftop solar potential

We brought FedEx’s golden solar opportunity to their doorstep